Key benefits of our program:

- Rates up to 20% below competitors.

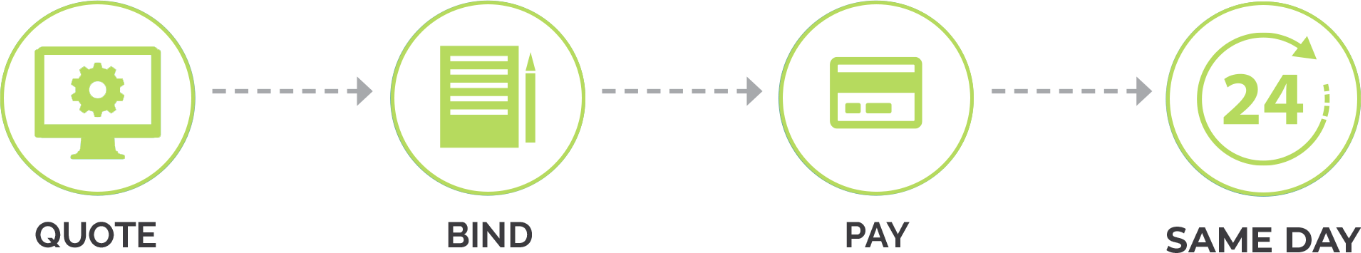

- Flexible Terms: New Business (3, 6, 9, 12, 18), Extensions (1, 2, 3, 6, 12). Not to exceed 24 months.

- Insures up to $10 million per job site. Covers the remodeling, renovation or new construction of “ground up” type residential and light commercial projects up to three stories.

Flexible terms can bring significant savings. Why pay for insurance that won’t be needed?

Save your clients money, and you’ll earn their gratitude and repeat business.