Enhance your Independence Blue Cross

Learn more and complete your health care coverage with these plans!

You have access to important health benefits, thanks to your Independence Blue Cross medical coverage. But how would you pay for other unexpected costs that come from being sick or getting in an accident? Expenses like copays, deductibles and living expenses while you recover can take almost anyone by surprise.

Solutions from LifeSecure Insurance Company can help you plan for the unexpected. Pair them with your Independence Blue Cross medical plan to extend your coverage and offset out-of-pocket expenses.

Independence Blue Cross is an independent licensee of the Blue Cross and Blue Shield Association. The products listed are offered by LifeSecure Insurance Company (New Hudson, MI), an independent company. These are not Blue Cross products. Independence Blue Cross is acting solely as an agent for LifeSecure. LifeSecure is solely responsible for the administration of its products.

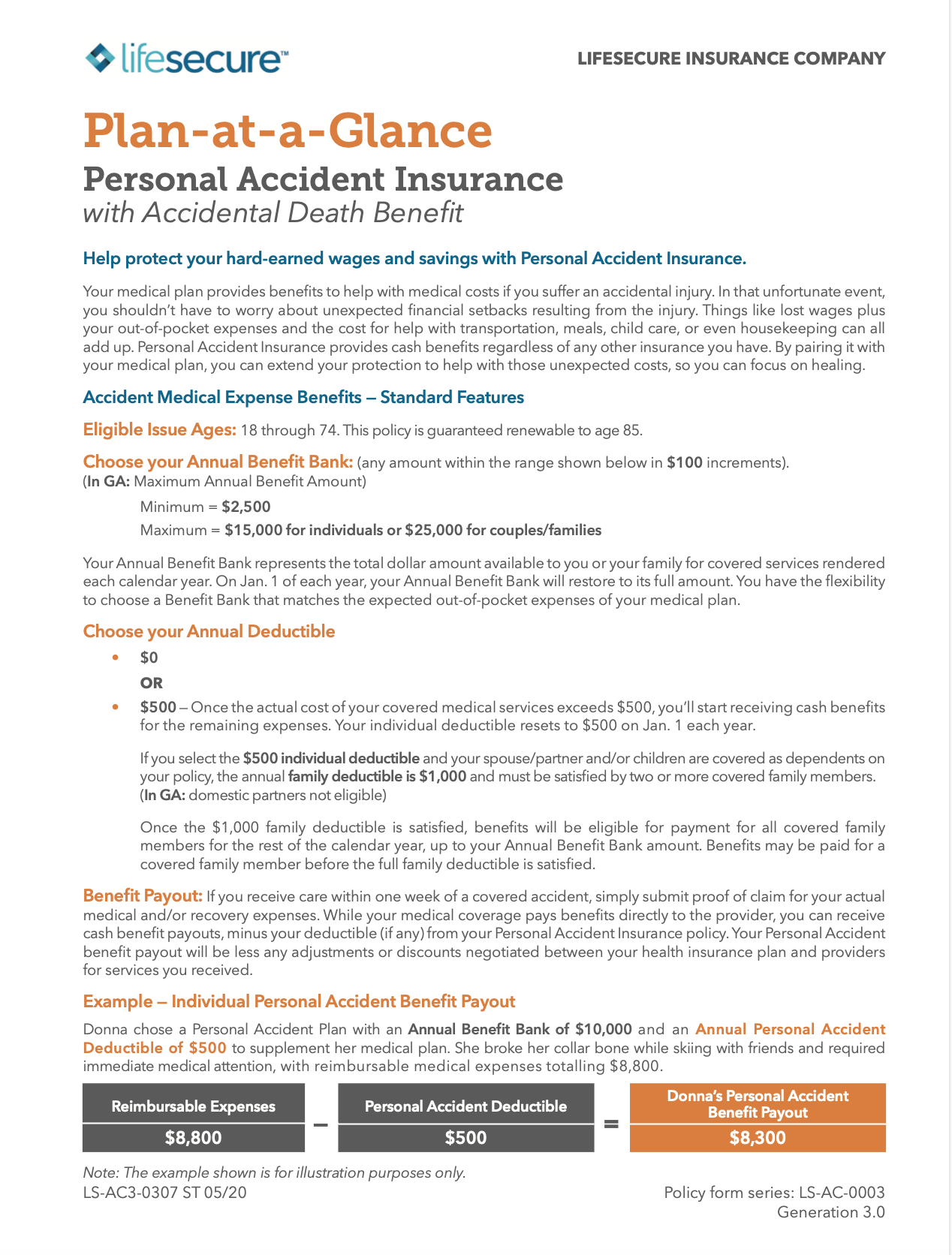

Personal Accident Insurance

helps you handle bills and other out-of-pocket costs after an accidental injury.

It pays cash benefits regardless of any other insurance you have, and no health questions are required to apply.

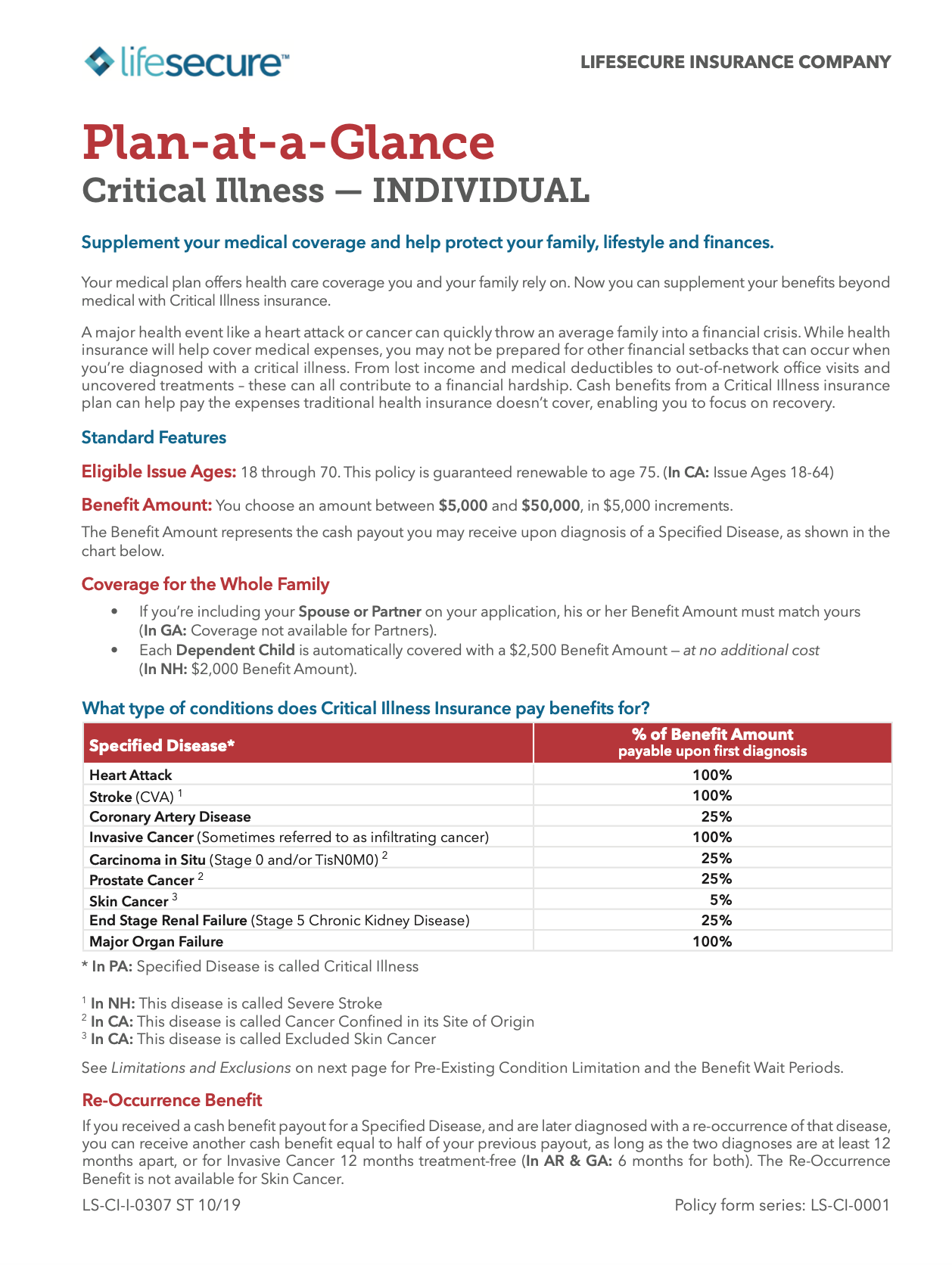

Critical Illness Insurance

provides important financial support should you experience a heart attack, stroke, cancer and other serious illnesses.

Use your benefits to offset the cost of care, out-of-network visits, living expenses and more.

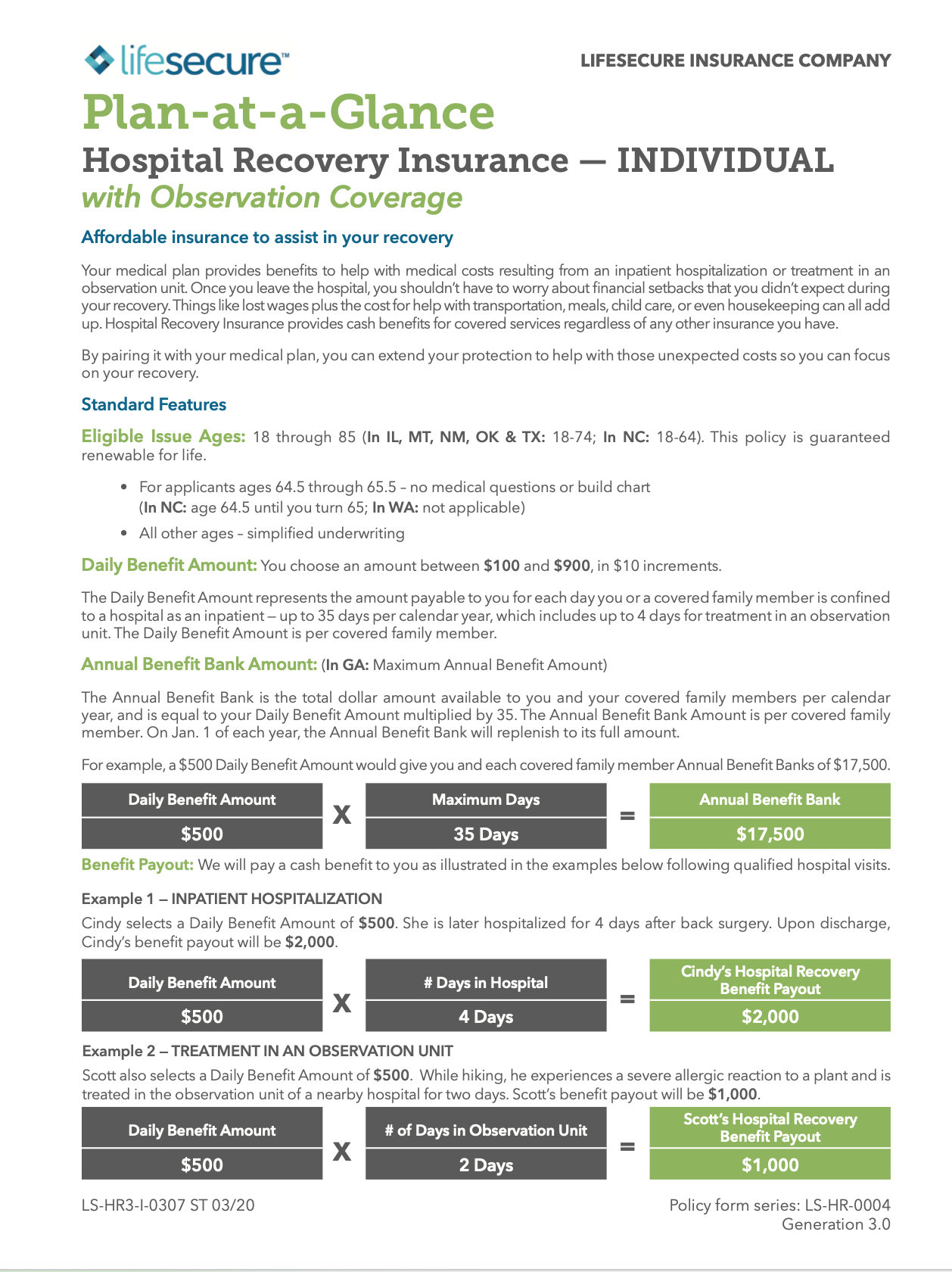

Hospital Indemnity Insurance

helps you pay unexpected expenses following a hospital stay.

Receive a cash benefit for each day of your qualified hospital stay to help you recover with less worry.

Offered for sale in cooperation with

medical coverage